10xbanking

HQ Location: London, UK | Founded: 2016 | 420 employees10x is a financial services technology company with a mission to move banks from monolithic to next-generation core banking solutions delivered through the world’s most comprehensive and powerful cloud native SaaS bank operating system.

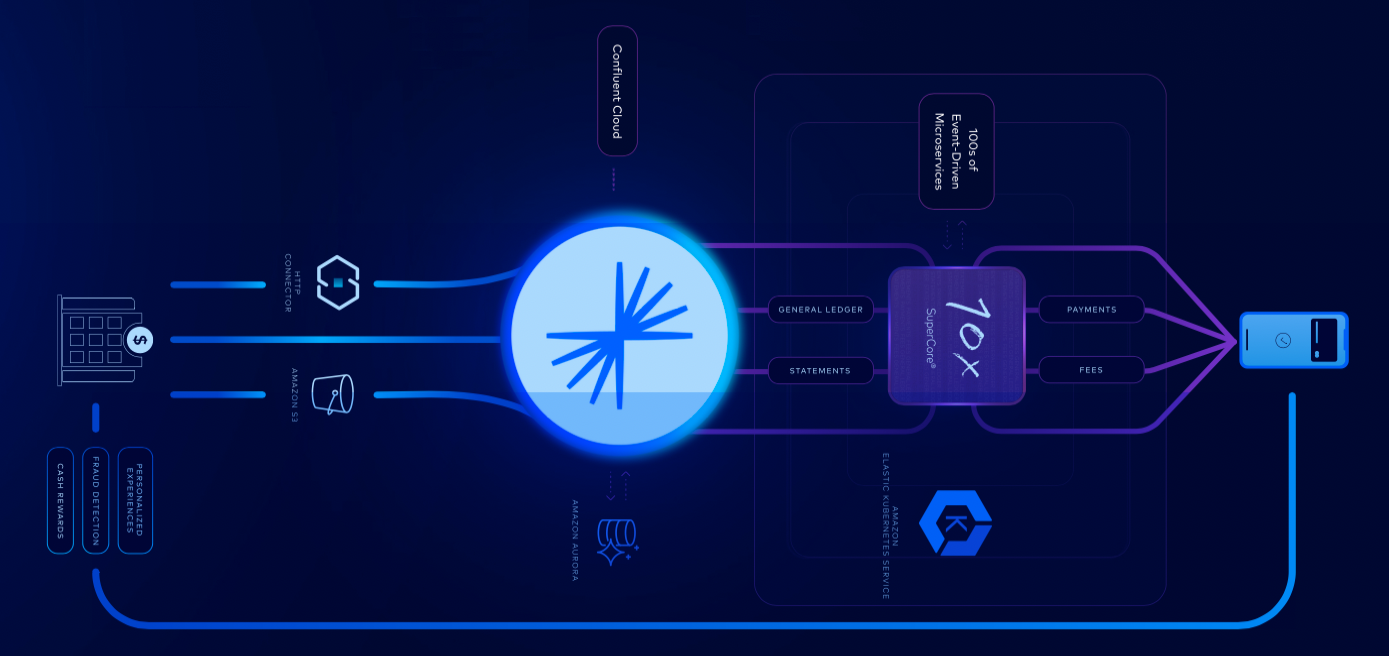

10x Banking Powers Financial Services Transformation with Confluent

Confluent Cloud is the core of the architecture of the SuperCore banking platform offered by 10x. Confluent helps them to:

- power event-driven microservices architecture - they can flexibly add real-time services with no point-to-point wirings or tight coupling

- build real-time data pipelines - 10x can send data directly to the clients banking system

- shared trusted and high-quality data

- provide a simple data interface to clients banks

- seamlessly leverage AWS services

Billie

HQ Location: Berlin, Germany | Founded: 2016 | 202 employeesBillie is the leading provider of “Buy Now, Pay Later” payment methods for businesses, offering B2B companies innovative digital payment services. They enable companies to pay and get paid on their own terms simply and easily, through modern checkout solutions. Based on proprietary, machine-learning-enabled risk models, fully digitized processes and a highly scalable tech platform, Billie offers freedom to big and small businesses alike through fast liquidity, automated workflows and access to modern payment solutions.

Billie Successfully Fights Fraud and Boosts Innovation With Snowflake Data Cloud

“While we started experimenting with various data analytics vendors, nothing matched the performance and efficiency we needed for our analytics and data science workloads. I was dreaming of a solution that could offer peace of mind and performance in one—that’s when I discovered Snowflake.” - IGOR CHTIVELBAND, VP Data at Billie

Snowflake helped Billie:

- efficiently scale its operations and secure $100 million investment.

- set up rules and alerts to help fight fraud ($3,3 million saved in potential fraud)

- empowering data-driven decision-making across the company (from senior executives to data engineers)

Banking Circle

HQ Location: Luxembourg, Luxembourg | Founded: 2016 | 747 employeesBanking Circle is the payments bank for the new economy, delivering payments and banking services by connecting to the world’s clearing systems.

Cloud-based infrastructure with Microsoft Azure

Banking Circle successfully completed a full migration to the cloud in March 2021 after moving its core banking system to Microsoft Azure. This has compressed transaction processing times from multiple hours to within a single hour.

Cloud-enabled capacity and efficiency has equipped Banking Circle to handle three times the number of daily transactions and improving efficiency tenfold. This decisive, large-scale transition has also enabled the organisation to improve internal processes, and to explore new opportunities for innovation.

Adyen

HQ Location: Amsterdam, Holland | Founded: 2006 | 3700 employeesAdyen is the financial technology platform which provides end-to-end payment capabilities, data-driven insights and financial products in a single global solution.

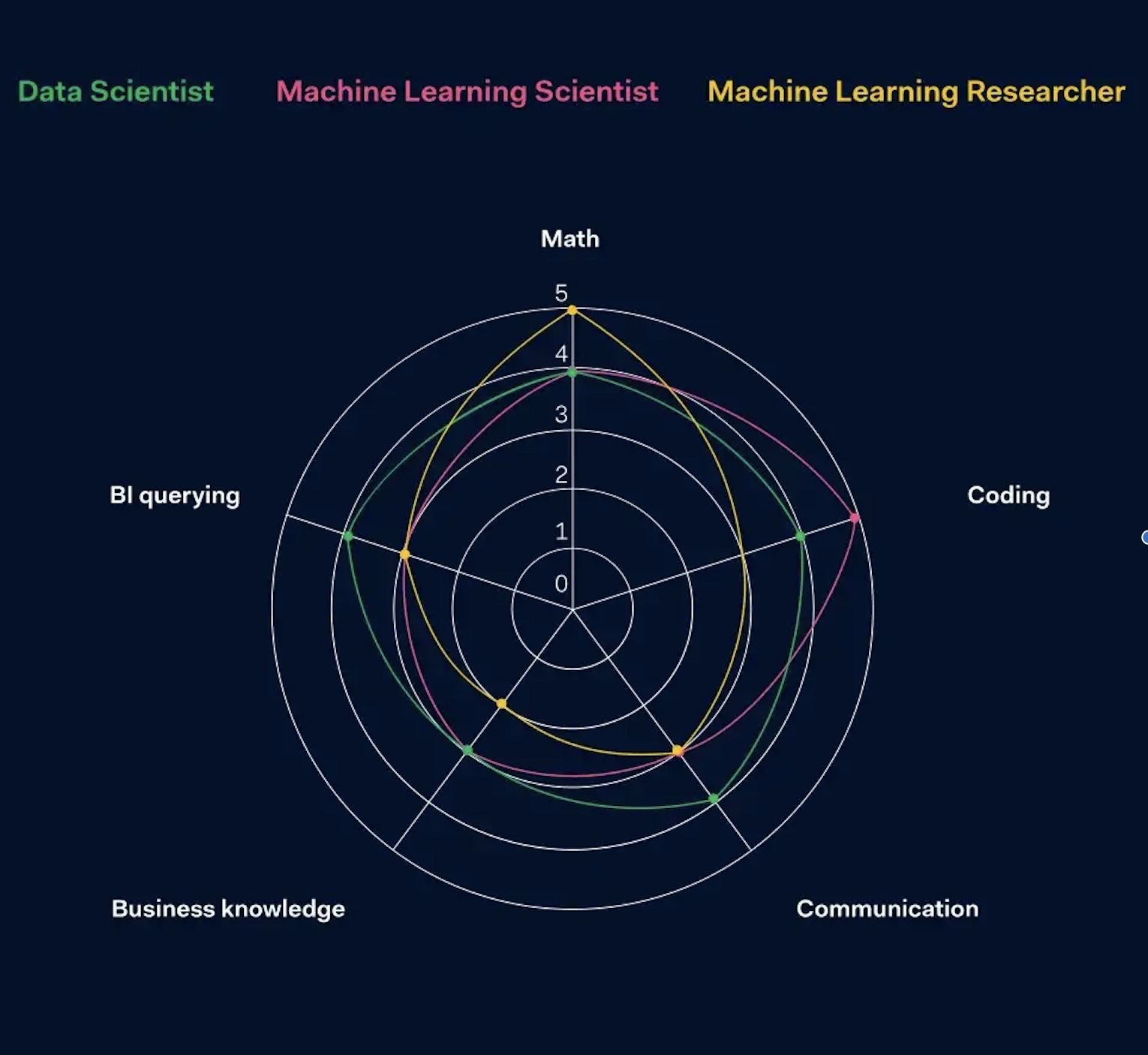

Defining data roles when scaling up data culture

At Adyen we see extracting value from data as a continuous process, since technologies, products, the market and ourselves as a company evolve at a tremendous speed. We have learnt a ton of lessons by creating and applying new algorithms, putting ML models in a production flow where hundreds of billions circulate or by creating an adequate infrastructure to do that.

Think

HQ Location: London, UK | Founded: 2016 | 420 employeesThink is Europe’s leading open banking platform that enables banks, fintechs and startups to develop data-driven financial services. Through one API, Tink allows customers to access aggregated financial data, initiate payments, enrich transactions, verify account ownership and build personal finance management tools

Tink Onboards Customers in a Couple of Days Using AWS

Tink’s platform runs on the Amazon Web Services (AWS) Cloud. Thanks to this they are able to:

- Onboard customers in a couple of days

- Build, train, and deploy ML models in hours - they used Amazon SageMaker to improve ML

- Avoid the need for database expertise

RenoFi

HQ Location: Philadelphia, USA | Founded: 2018 | 80 employeesRenoFi is a U.S.-based FinTech that uses the after-renovation value instead of your home's current value, enabling you to borrow the most money at the lowest rates.

Doing more with less with a Modern Data Platform and ML at home renovation FinTech

During the discussion with Adam Kawa, Michał Wróbel said:

“It's fairly easy to have a batch ML prediction, compared to online predictions and we've been playing with that. And for batch ML on Google, you can use DBT with BigQuery ML. And that's what we've been trying to do. In BigQuery ML, obviously there's one pain point because usually data scientists are used to Python and all the transformations they do, they've been taught in Python and that's the main thing they're using. But because dbt these days is such a success and you can SQL is a lingua franca of data and everyone knows it.”

Trustly

HQ Location: Stockholm, Sweden | Founded: 2008 | 791 employeesTrustly work hard to make online payments fast, simple and for everyone - merchants, consumers and banks alike.

Implementing a Streaming Data Pipeline

Producers -> Pub/Sub -> Beam (Dataflow) -> Google Cloud Storage -> Airflow (Cloud Composer) -> BigQuery -> dbt -> BigQuery -> Consumers

About a year ago, Trustly built a framework that would improve the ingestion of data into their data platform. This solution has been live in production for a few subcomponents of their payment system since late August, and they are still evaluating how to improve it.

Volt

HQ Location: London, UK | Founded: 2019 | 120 employeesVolt is building the global infrastructure for real-time payments.

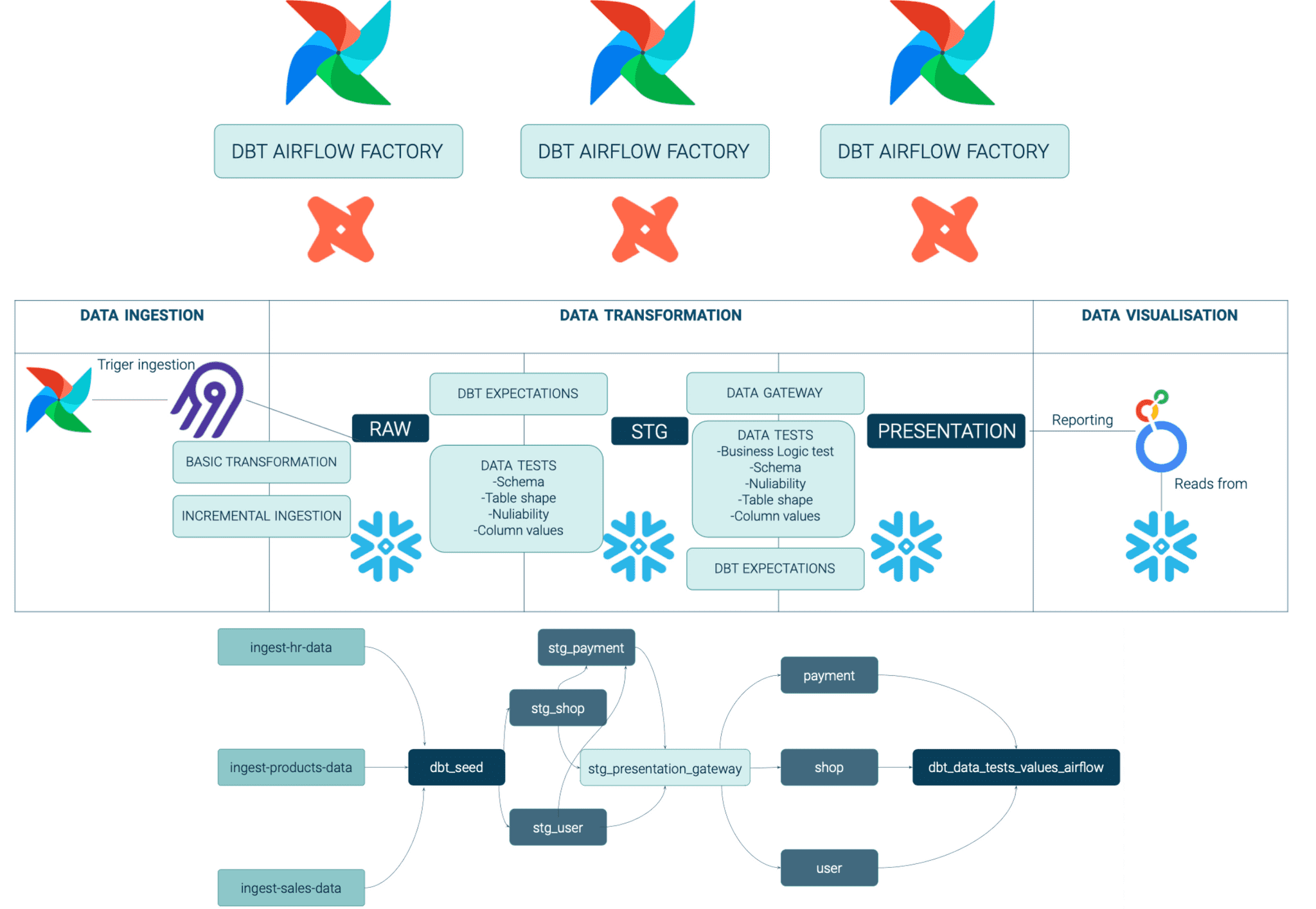

How we built a Modern Data Platform in 4 months for Volt.io, a FinTech scaleup

Volt.io is building the world’s first global real-time payment network, powered by open banking. To build a payment platform that is fast and reliable, they need to use huge amounts of data from different sources such as: translation status, transaction quality, availability of banks, quality of internal processes and more. They decided to create a platform that processes and combines data from all sources. Together with GetInData, they designed and implemented a Modern Data Platform that was based upon Cloud components including data ingestion(Airbyte), data transformation (dbt), orchestration (Amazon Managed Workflows for Apache Airflow) and a data warehouse (Snowflake). If you want to know the architecture details, check out this blog post.

Scalable Capital

HQ Location: München, Germany |Founded: 2014 | 408 employeesScalable Capital is bringing people and technology-based investment together. The company creates and manages globally diversified ETF portfolios for its clients with sustainable investment strategies when desired. The broker enables private individuals to trade shares, ETFs, Crypto ETPs, funds and derivatives themselves and to set up ETF and stock savings plans.

Amazon Web Services in Scalable Capital

“We went through the regulation process with AWS as our architecture. Amazon Web Services helped us a lot in providing the relevant data to the regulator so that they are satisfied with our compliance setup. Amazon Web Services data centers have a number of certifications and we were also to provide permissions and access control accordingly to the regulator. Moreover, there are other requirements like failover failsafe mechanisms, backup mechanisms and disaster recovery mechanisms all of which could be built on our own as well but would require much more effort. These things are covered by Amazon web services.” - dr. Andreas Schranzhofer, CTO

Ark Kapital

HQ Location: Stockholm, Sweden | Founded: 2021 | 52 employeesArk Kapital is a precision financing company that empowers technology businesses to grow faster, enables owners to maintain control and reduces risk for investors.

Ark Kapital launch the forecasting platform giving founders control of their growth

In November they launched an AI-driven forecasting platform - AIM to the public. This platform lets the founders understand what they built thanks to raw data and simulate a 5-year future, thanks to historical achievement. You can read more about the platform in this article.

Stripe

HQ Location: San Francisco, USA | Founded: 2010 | 8329 employeesStripe is a financial infrastructure platform for businesses. Millions of companies—from the world’s largest enterprises to the most ambitious startups—use Stripe to accept payments, grow their revenue and accelerate new business opportunities.

Stripe infrastructure based on AWS

“AWS has given us world class infrastructure, scaled seamlessly with our growth, and most importantly, has allowed our developers to be as productive as they can be. The first thing I want to talk about is access to world class infrastructure. AWS operates at a scale and level of sophistication that we could never hope to reach on our own. Not only do they give us access to data centres around the world, but they also build infrastructure services that we couldn't hope of building ourselves. To get the security guarantees that we want for our to get the security guarantees that we want for our infrastructure.” - Jorge Ortiz, Manager at Stripe

Willa

HQ Location: Stockholm, Sweden; Los Angeles, USA | Founded: 2019 | 63 employeesWilla is a payments and invoicing app for US-based freelancer

Learning From Experiments Without A/B Testing - Case Study

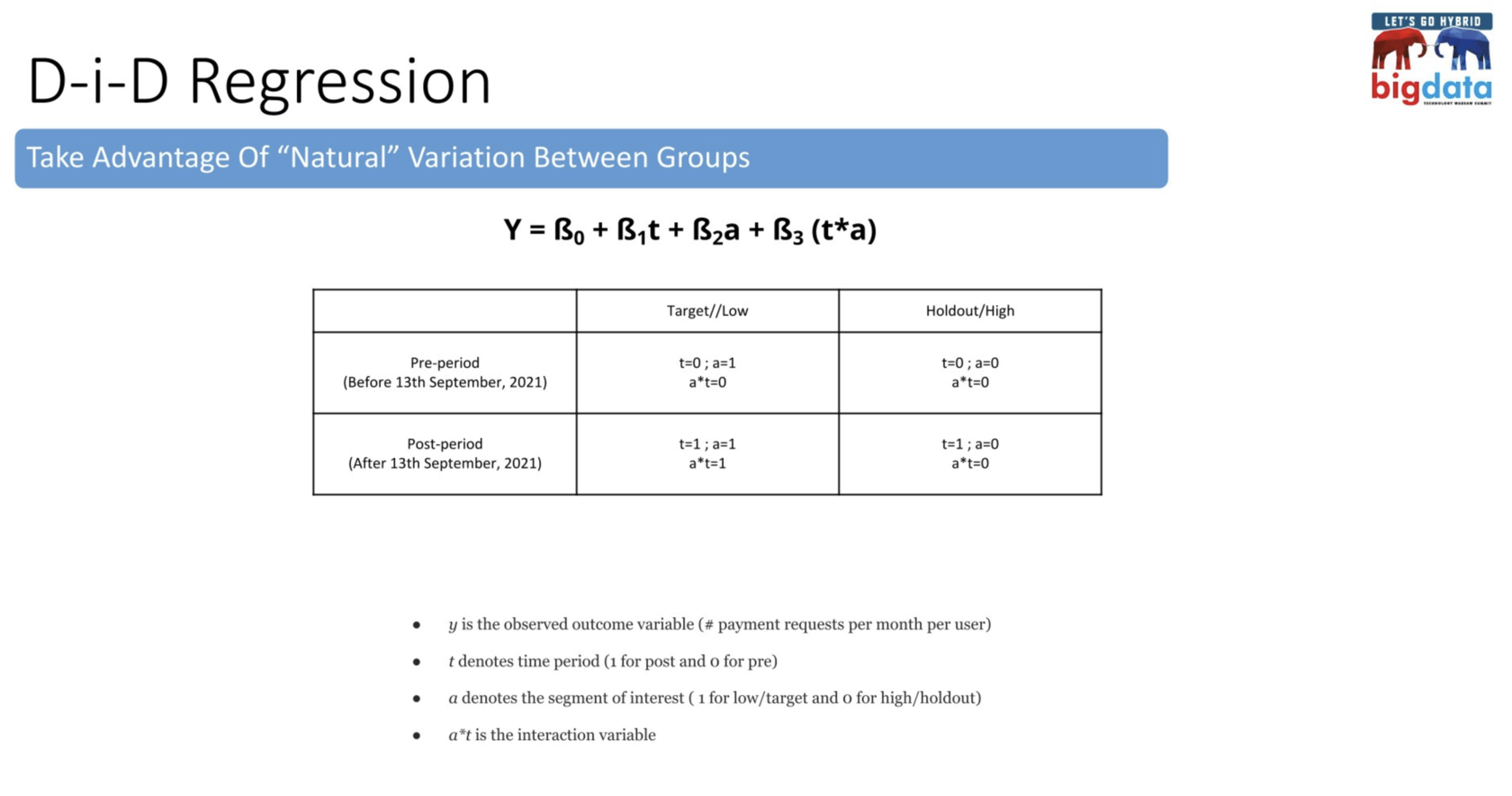

During the conference Arunabh Singh and Qi An presented one of their product experiments from Willa around how to utilize econometrics for causal inference in the absence of A/B testing. They used an econometric technique called Difference-In-Differences (D-I-D) regression to tease out the causal impact of simplifying the invoicing process using their app, on the invoice creation rate per user. They took advantage of natural variation in product usage between different kinds of users, and were able to reach statistically significant results cheaper and faster than via A/B testing.

During this, they used technologies such as BigQuery and Jupyter/Databricks, and GCP more broadly, although the approach is platform agnostic.

________________________

Have any interesting content to share in the DATA Pill newsletter?

➡ Join us on GitHub